top of page

GROW

WITH

YOUR TIPS

Instant Tip Access & Money Management

Receive your tips directly into your HausMoney digital account!

.png)

All-In-One Financial Solution

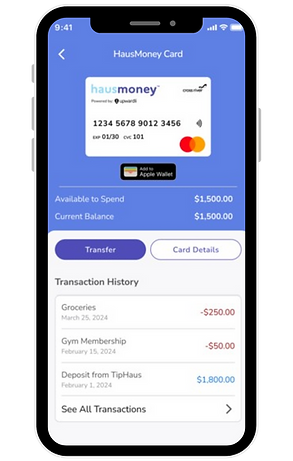

Manage your card and direct deposit, and control your financial health all in one convenient and easy-to-use mobile app.

Roam with HausMoney

If contactless spending is more your vibe, we got you. Add your HausMoney Card to your digital wallet and pay with Apple Pay & Google Pay.

Build & Boost Your Credit History

Build a credit history with every swipe of your card. This means better chances for low-interest car loans and mortgages, better credit opportunities, and a more robust credit history for financial success.

_edited.png)

.png)

Card Comparison

* Since the money is held on the card, there is no interest charge.

** There is a $1,000 daily limit; there are In-Network ATMs for fee-free withdrawals.

*** Some credit cards may charge an annual fee, credit cards also charge interest on any balance you carry over from month to month, and there is a required minimum monthly payment on a typical credit card.

Keep Tabs on Your Spending and Activity

Keep an eye on your HausMoney card activity, tip-earning deposits, transfers, payroll direct deposits, and more - all in the app!

Powered By:

bottom of page